It is a type of secured loan which means it is taken using collateral. In that case, the collateral is the item you value and leave with the pawnbroker. If the loan is paid off in time then you get your pawn back but if you do not pay back then pawnbroker then pawnbroker gets to keep your pawn and sells it in their shop as payment of loan. This loan does not require a good credit score using it as a last resort to make quick cash flow. All are risky financially but pawnshop are least damaging because they do not affect your credit score. Pawn Shop loans are the oldest forms of lending.

When are Pawn Shop Loans a Smart Move?

If you need money, it’s always better to take loan in way which will save money, build credit and access a larger amount of money, there are few cases where loan can help you:

● When you need cash immediately.

● When you need a small amount of money.

● When you have an item of value that is ok for raising money with potentially losing it.

Pros of Pawnshop Loans

● Quick Funding: You get a loan from a pawn shop in just a couple of minutes.

● Does not affect credit score: You do not have a good credit score to get a loan and even if you do not pay on time, it does not hit your score.

● No argument from creditors if you do not pay back: You won’t get reported to the credit bureau if you don’t pay back the loan.

Cons of Pawnshop Loans

● Potentially expensive: The financing fees of pawn loans are more expensive than traditional loans.

● Loans are for small amounts: If you want a small loan, figure out the item’s resale value for a small amount.

● Can lose the item: If you do not pay back, the pawnbroker gets to sell that pawn.

● Does not build or help credit score.: Pawn loans do not report to the credit bureau about miss payment of loan.

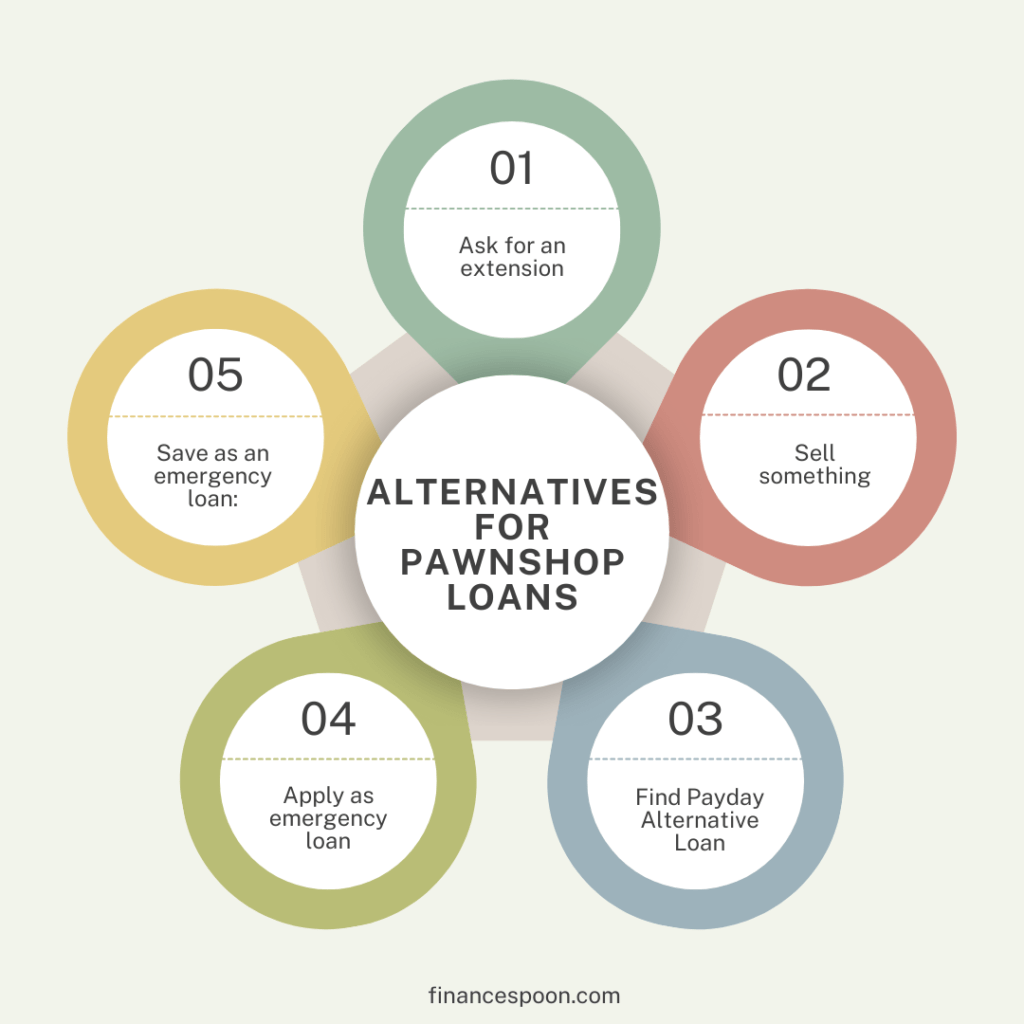

Alternatives For Pawnshop Loans

● Ask for an extension: If you have bills to pay, companies are willing to work with you if you have temporarily financial fund

● Find help from charity: Great resource for finding local charities that offer temporary help.

● Sell something: Pawnshops are not the only shop that helps to sell items, you can get better prices at Facebook market etc.

● Find Payday Alternative Loan (PAL): Some credit union offer small dollar loans to members as PAL

● Apply as emergency loan: You can take emergency loans can apply and get approved easily

● Save as an emergency loan: If you have an emergency fund, the next time you hit a rough patch, it acts like a safety cushion.

What to Do if You’re Having a Tough Time Paying Bills?

● Trim Expenses: It may be hard to cut cost when you struggle but you can do it by giving up online subscriptions and eat meals at home.

● Make Money Through a Side Gig: Even temporarily consider working side gig to earn extra money like online tutoring or food delivery services

● Ask About Payment Plans: Reach out creditors and see type of plan can lower monthly payments over time

● Get Help From a Credit Counsellor: A credit counsellor can create a plan to pay off your debt easily.

Leave a Comment