Owning a business is a dream too good to be true. If I didn’t think

through the finances put to run a business would turn into a nightmare.

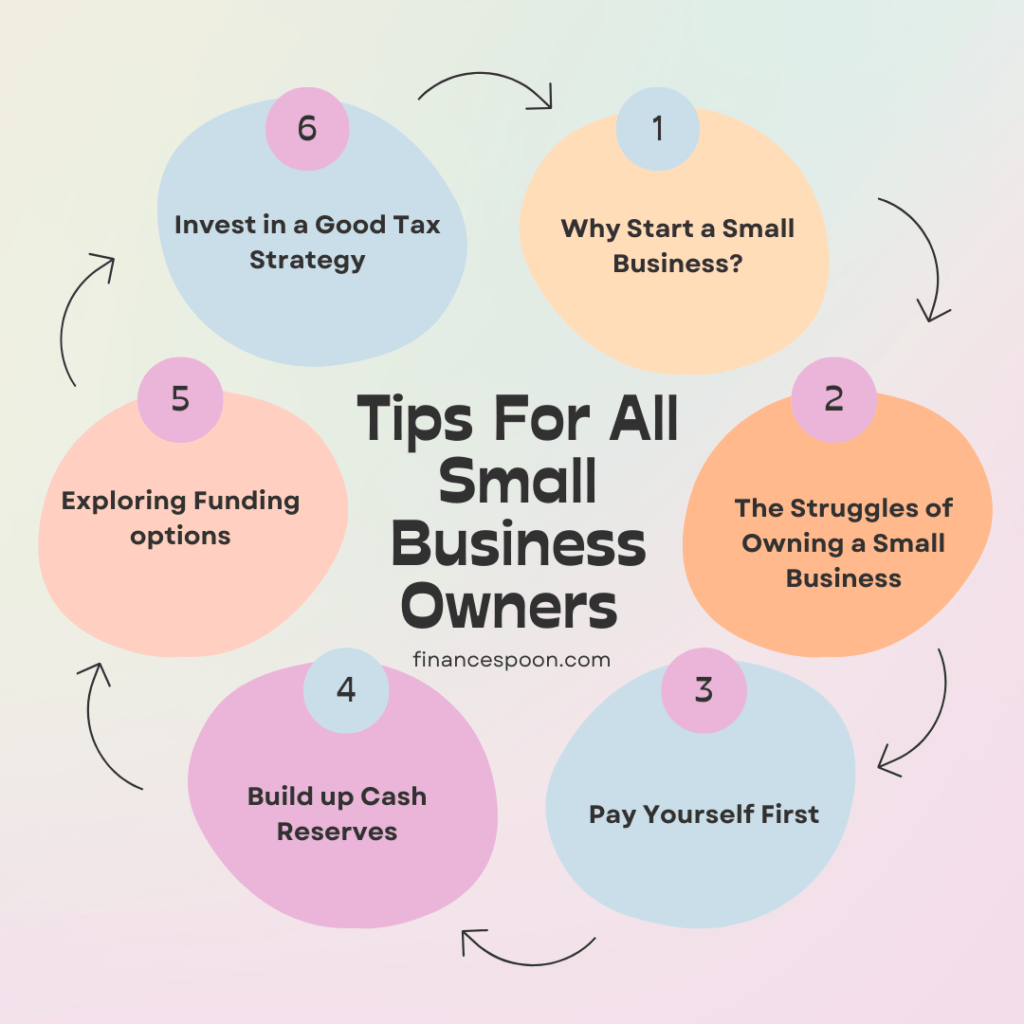

There are ways to stay on top of money with financial tips:

● Pay yourself first.

● Build up cash reserves.

● Explore funding options.

● Invest in a good tax strategy.

● Constantly review your contracts.

● Network with other business owners.

● Learn how to use social media and social media ads.

- Why Start a Small Business?

Normally, people start doing business so that they can be their own boss which means they want to build up something from ground and the others are motivated to make more money. They are motivated by the idea of freedom and pursuing your dreams.

- The Struggles of Owning a Small Business

It is true that business owners soon learn that running a business can’t be just run on freedom and dream. There are downsides to consider like self employment such as lack of benefits, long work hours and financial fatigue. Many economics and business point to a variety of reasons why business fails because of cash flow problems including miss-management. In other words, freedom and dreams do not pay your bills. Running business requires good grasp of finances:

- Pay Yourself First

Proper money management is a key aspect of growing your business. Some owners does make a mistake of not paying themselves an adequate salary as they put every money into business. Owners need to make a budget which includes salary for themselves so that they can handle their own household financial solvent.

- Build up Cash Reserves

Financial planning is very helpful for business as it acts as a backup option during tough times like recession or inflammation which happens every 5 years or even during seasonal changes which might affect the business. Emergency funds are helpful during these times. Financial advisors also recommend keeping at least 06 months of cash reserves which helps small business owners to pay bills, vendors, contractors and payroll from time to time. You can create cash reserves by keeping aside a fixed amount of money every month or every week in reserves.

- Exploring Funding options

Many owners do a poor job which ends their funding option while there are other options that can be used as funding options. There are traditional bank loans and private small business loans that offer long and short term funding options. If you have the right network of people, you might know angel investors who might be interested in investing in your business.

- Invest in a Good Tax Strategy

One of the mistakes done by owners is paying taxes on their own, instead of doing that they can find a competent accountant or a tax advisor which can help to set up a business as a corporation. It also allows owners to pay themselves and set the rest of business income as profit.

Leave a Comment