Life insurance financially protects your loved ones when you pass away. But what if you – the policyholder – die while you are out of the country?

In most cases, the life insurance will provide a payout if the policyholder dies abroad. However, this may not happen in every case. Especially, when your destination is of primary concern for insurance companies when deciding a payout.

So, if you want to know if your life insurance will payout if you die abroad, then continue reading as this life insurance guide will address this and other common life insurance questions.

Will My Life Insurance Payout if I Die Abroad?

The short answer is Yes! Your policyholder will payout if you die abroad. Most life insurance companies cover even if you pass away anywhere in the world.

It also stands true when you renounce your US citizenship or move abroad permanently. The only thing required is disclosing all of your information at the time of application.

However, this is not the case with all insurance companies. There are also instances when a life insurance policy will not pay out if you die outside of the US.

So, let’s explore the cases when the policy would not payout for any policyholder.

Hide International Travel on the Application

It is the most critical factor in deciding whether you will get a payout if you die abroad or not. Do not hide this, and always be honest and upfront on your life insurance application. Try to answer every question truthfully to avoid any untoward things in the future.

Companies often evaluate your application and use the provided information to determine the overall risk. Some ask about past travels based on your residence state, and others ask about future travel plans.

So, if you have plans to travel outside of the US, be upfront and tell them about it. They will probably ask where you plan to go, the duration of your trip, and the purpose of the trip. Setting up things before time will make the payout process easier for your loved ones.

Suspicious Death

It sounds like a Hollywood film script, but companies withhold payment if the cause of death is not confirmed. It does not mean they will not pay. However, the process will be slow, and your loved ones will have to wait longer.

It can happen both inside and outside US death, but the time-lapse increases more when the insurance company relies on foreign intelligence to lead the investigation.

Act of War

A policyholder’s death is considered an act of war when he was on active duty in the military, has been a member of or applied for membership, or received a notice of required service in the Armed Forces, National Guard, or the Reserves.

Declared or undeclared, companies will not pay out if your death was due to the Act of War.

Commit Suicide

Suicide is always an exclusion for the first 2 years of the policy in any insurance company. In simple words, if you commit suicide, whether in the US or abroad, your policy is not liable to pay you out.

Once you know the instances when life insurance payout is denied, let’s find out the steps your family needs to follow when you die abroad.

Steps To Take If You Die Abroad

Here are a few steps your family needs to take if you pass away abroad.

Get Death Certificate

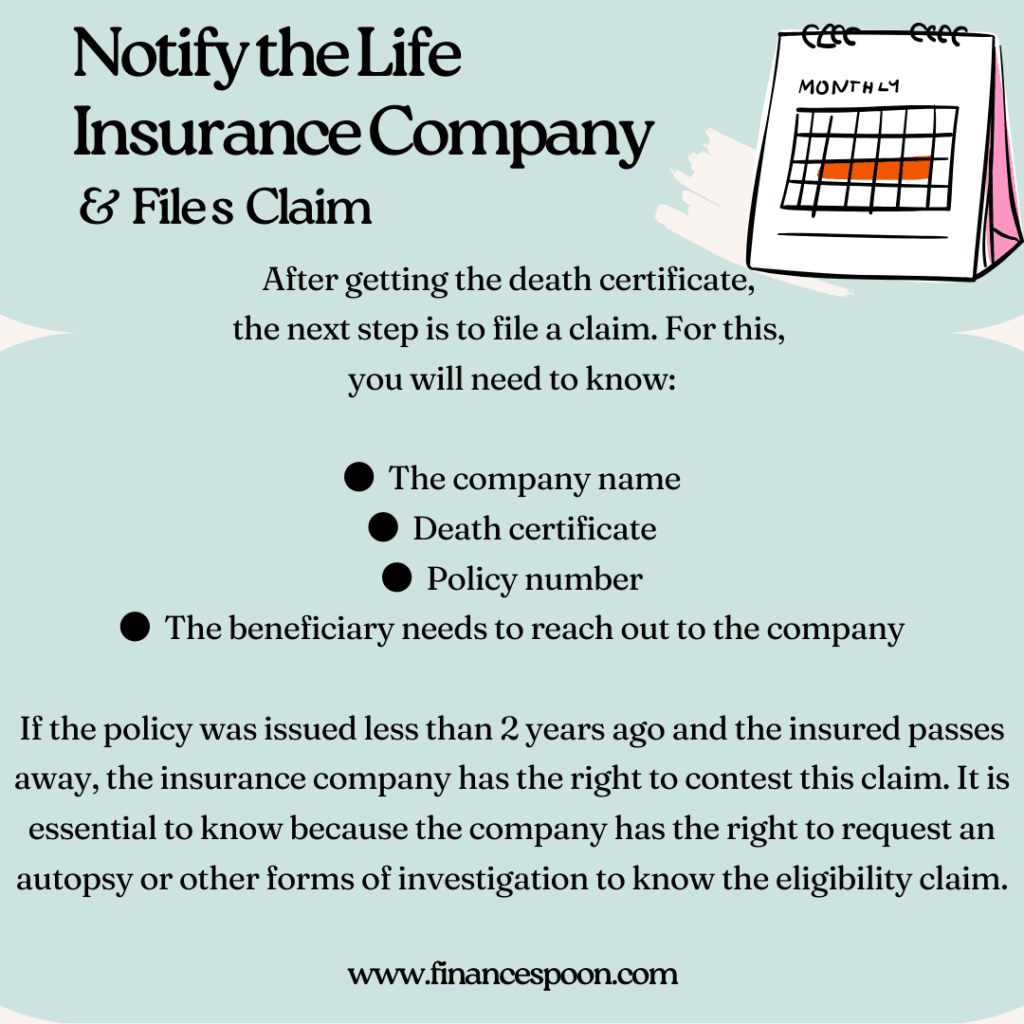

If any person dies, the local authorities issue a death certificate. Make sure you get the original and a certified copy of it. Also, make sure you get it copied multiple times, as different agencies need it for the record.

After getting the certificate, inform the US Embassy that the insured had passed away if the policyholder was from the US. Additionally, the Embassy may be able to help you with making the arrangements and advise you of the steps to follow ahead.

Can I Name a Beneficiary Who Lives Outside of the US?

The short answer is yes; you can name someone as a life insurance beneficiary even if the person is not living in the US. But again, the biggest concern for the insurance company will be ‘why’ they are your beneficiary and what is the insurable interest in your life.

Before naming any beneficiary, make sure you have given the beneficiary the policy information and agent’s information. It will ensure the person has a point of contact to which they can reach out in case something happens to the policyholder.

It is essential to mention that while selecting your life insurance policy, make sure that the company you are working with is financially strong and has been in business for a long time.

Also, try to find out if it’s A-rated or better. It will give you the peace of mind that your policy will not fill the exclusions.

The Bottom Line

Most life insurance companies will approve the payout if the policyholder has died overseas, but the exceptions exist too.

However, if you want to ensure the payout, there are steps like being upfront about your travel habits that you can follow. Medical life history and lifestyle are also two critical factors life insurance companies consider when approving the policy.

Being honest about your travel plans and habits will ensure the beneficiary does not have to go through any difficulties while claiming the payout.

Leave a Comment